The world of finance is full of firms promising to back bold ideas, but only a handful actually deliver consistent results while shaping industries across the globe. OnPressCapital is one of those few. Known for its long-term investment philosophy, diverse portfolio, and global reach, the firm has steadily earned recognition among startups, growth-stage businesses, and institutional investors.

This article takes a deep dive into what OnPressCapital is, how it invests, where it puts its money, and why it stands out as more than just another capital provider. By the end, you’ll see exactly who can benefit from OnPressCapital and what makes it unique in today’s competitive investment landscape.

Table of Contents

What Is OnPressCapital?

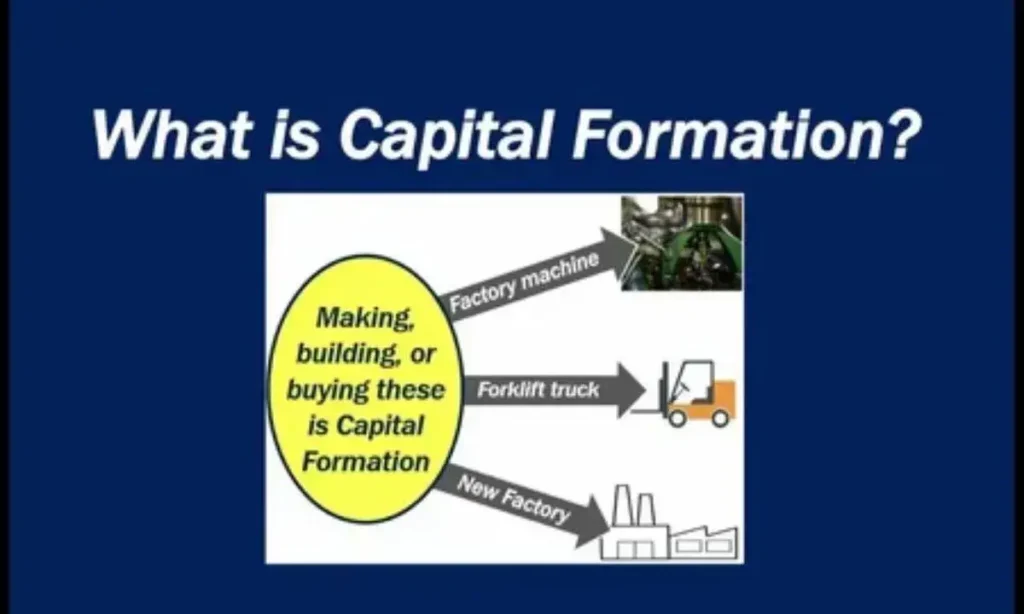

At its core, OnPressCapital is an investment firm that combines venture capital, private equity, and alternative investments into one strategy. Unlike traditional firms that focus on a single investment model, OnPressCapital blends multiple approaches to balance risk and reward.

Mission and Philosophy

The firm’s guiding principle is straightforward: provide patient capital while actively supporting portfolio companies. This isn’t about chasing short-term returns. Instead, OnPressCapital often takes a 5–10 year investment horizon, allowing businesses time to grow sustainably.

Its philosophy rests on three pillars:

- Sustainable growth – backing companies with scalable, environmentally conscious models.

- Balanced risk – spreading investments across industries and geographies to reduce volatility.

- Operational support – not just funding, but mentorship, strategy, and hands-on expertise.

Quote from an OnPressCapital partner:

“We don’t just fund businesses; we grow them. Our capital is paired with strategy, networks, and insights that help founders achieve scale beyond what money alone can do.”

How OnPressCapital Invests

Unlike firms that only write checks, OnPressCapital takes a diversified approach to investment. It uses different vehicles depending on the stage and maturity of the business.

Investment Types

| Investment Type | Typical Target | Purpose |

|---|---|---|

| Venture Capital | Startups (Seed, Series A, Series B) | Fuel product development, early market entry |

| Private Equity | Growth & mature companies | Expansion, acquisitions, restructuring |

| Alternative Investments | Hedge funds, commodities, real assets | Portfolio diversification, hedge against risk |

Operational & Strategic Support

Beyond funding, OnPressCapital actively helps its portfolio companies. This includes:

- Mentorship: Guiding founders through challenges of scaling.

- Market Research: Providing insights into trends and consumer behavior.

- Hiring Support: Helping secure top-tier talent for leadership roles.

- Go-to-Market Execution: Assisting with partnerships, distribution, and international launches.

Investment Criteria

When deciding where to invest, OnPressCapital looks for:

- Growth potential: Scalable business models with strong unit economics.

- Innovation: Companies pioneering AI, renewable energy, fintech, or healthcare solutions.

- Sustainability: Businesses aligned with ESG (Environmental, Social, Governance) standards.

- Global readiness: Ability to expand across markets and borders.

Where OnPressCapital Puts Its Money

OnPressCapital’s portfolio spans multiple industries and continents. This global diversification helps shield against market volatility while tapping into high-growth sectors.

Geographic Focus

- North America: Investments in technology and healthcare hubs like New York and Silicon Valley.

- Europe: London as a financial center, plus investments in renewable energy.

- Asia-Pacific: Hong Kong, Singapore, and emerging markets where tech adoption is booming.

- Emerging Markets: Select plays in Africa and Latin America focused on fintech and clean energy.

Industry Focus

| Sector | Why OnPressCapital Invests |

|---|---|

| Technology (AI, SaaS, Fintech) | High scalability, disruption potential |

| Healthcare & Biotech | Growing global demand, life-changing innovations |

| Clean Energy & Renewables | Long-term sustainability, ESG alignment |

| Consumer & E-commerce | Rising digital adoption, cross-border growth |

Case Study: AI-Driven Startup in Healthcare

OnPressCapital invested early in a biotech AI startup that developed predictive algorithms for drug discovery. Within five years:

- Revenue grew 5x through global partnerships.

- The company expanded into Europe and Asia.

- OnPressCapital’s network connected the startup with Fortune 500 healthcare firms.

This case illustrates the firm’s ability to back high-risk, high-reward ventures while providing the strategic scaffolding needed for global success.

More Than Just Money

The phrase “capital alone isn’t enough” defines how OnPressCapital operates. Unlike traditional firms, it provides a package of services that go beyond funding.

Active Involvement

- Works alongside founders in board meetings.

- Assists in refining business models.

- Connects companies with global partners and clients.

Research and Insights

OnPressCapital maintains an internal research division that monitors:

- Market trends in AI, fintech, and biotech.

- Regulatory shifts across regions.

- Consumer behavior in emerging economies.

This intelligence gives portfolio companies a competitive edge.

ESG and Impact Investing

- Prioritizes companies with sustainable business practices.

- Invests in renewable energy projects that support long-term climate goals.

- Encourages portfolio firms to adopt responsible governance structures.

Example: OnPressCapital’s clean energy fund has financed solar and wind projects in Southeast Asia, providing power to over 250,000 households.

A Global Reach

OnPressCapital isn’t confined to one market. Its global presence allows it to source deals worldwide while helping portfolio companies expand internationally.

Strategic Hubs

- New York: North American headquarters.

- London: European base for private equity and clean energy investments.

- Hong Kong: Gateway to Asia-Pacific markets.

Cross-Border Investment Advantages

- Gives startups access to international markets faster.

- Mitigates risk by spreading exposure across different economies.

- Enables knowledge transfer between regions (e.g., tech from Silicon Valley applied in Asia).

Adaptability to Market Shifts

During COVID-19, OnPressCapital shifted capital into resilient industries like healthcare tech and remote collaboration platforms. This ability to pivot kept its portfolio stable even when markets were volatile.

Why OnPressCapital Stands Out

In a crowded field of private equity and venture capital firms, OnPressCapital sets itself apart in several ways.

- Long-Term Horizon: Its 5–10 year strategy contrasts with firms seeking quick exits.

- Balanced Portfolio: Mixes venture capital with private equity and alternative assets.

- Operational Support: Provides hands-on help, not just cash.

- ESG Integration: Consistently aligns investments with sustainable practices.

- Global Reach: Combines presence in financial hubs with emerging markets.

Track Record

While private, OnPressCapital has reported above-market returns in several funds, driven by its early moves in AI, biotech, and renewables.

Who Can Benefit from OnPressCapital?

OnPressCapital isn’t for everyone. The firm is selective, but those who align with its vision stand to benefit the most.

Startups & Early-Stage Companies

- Access to Series A and Series B funding.

- Strategic guidance for product-market fit and scaling.

- Global connections to reach beyond local markets.

Growth-Stage Businesses

- Support for expansion, acquisitions, and restructuring.

- Mentorship for leadership teams navigating rapid scaling.

Established Companies

- Guidance for digital transformation or expansion into new sectors.

- Funding for restructuring or pivoting business models.

Investors

- Institutional and high-net-worth investors can benefit from exposure to diversified, high-growth portfolios.

- ESG-conscious investors gain from OnPressCapital’s sustainability-driven strategy.

Risks and Considerations

No investment strategy is risk-free. OnPressCapital itself acknowledges several risks:

- Long-term horizon: Returns may take years, limiting liquidity.

- Sector volatility: Biotech and emerging markets can face regulatory or political challenges.

- ESG trade-offs: Prioritizing sustainability can sometimes delay profitability.

- Due diligence needed: Investors must assess if OnPressCapital’s approach aligns with their risk appetite.

Conclusion

OnPressCapital has built a reputation as a forward-thinking global investment firm. By blending venture capital, private equity, and alternative investments, it creates a portfolio that thrives on innovation and sustainability. More than just capital, it provides mentorship, strategic guidance, and networks that help companies grow across borders.

For startups chasing scale, established firms seeking transformation, or investors looking for diversified exposure, OnPressCapital offers more than money—it offers partnership.