California’s SSIS 469 plays a vital role in ensuring that children receive the financial support they deserve. It’s part of the California Department of Child Support Services (DCSS) framework, designed to modernize how the state tracks, enforces, and audits child support cases. Understanding SSIS 469 isn’t just for lawyers or policymakers—it directly affects parents, families, and employers across California.

This guide provides an in-depth explanation of what SSIS 469 is, why it exists, how it works, and who it impacts, along with detailed insights into its legal background, benefits, and challenges.

Table of Contents

SSIS 469 Profile – Biographic Table

| Attribute | Detail |

|---|---|

| System Code | SSIS 469 |

| Full Form | Statewide Support Enforcement System Code 469 |

| Jurisdiction | California |

| Administered By | California Department of Child Support Services (DCSS) |

| Legal Foundation | Title IV-D of the Federal Social Security Act, California Family Code |

| Purpose | Standardized classification and enforcement of child support obligations |

| Primary Stakeholders | Custodial parents, non-custodial parents, employers, state agencies |

| Enforcement Tools Linked | Wage garnishment, tax refund interception, license suspension, bank levies |

| Integration | Linked to national systems like FPLS and OCSE databases |

What Is SSIS 469?

SSIS 469 refers to a specific classification code within California’s Statewide Support Enforcement System (SSIS). This system manages every child support case filed under Title IV-D of the federal Social Security Act.

Essentially, SSIS 469 helps DCSS categorize cases based on their enforcement status, compliance level, and administrative actions. Each numeric code corresponds to a specific condition—such as an enforcement trigger, arrears notice, or federal offset referral.

In simpler terms, if a parent fails to meet a child support obligation, SSIS 469 ensures the case is recorded correctly, enabling automatic actions like wage garnishment or tax intercepts.

Why Was SSIS 469 Introduced?

California introduced SSIS 469 to bring consistency and automation to child support enforcement. Before its integration, local agencies used different tracking systems, creating errors, delays, and duplicated data.

The key goals behind introducing SSIS 469 include:

- Compliance with federal Title IV-D mandates, ensuring federal funding eligibility.

- Centralized data management, so every child support action is traceable.

- Reduced clerical errors, minimizing disputes between parents and agencies.

- Increased enforcement efficiency, allowing faster intervention when payments lapse.

The SSIS 469 code also helps California align with federal audit requirements under the Office of Child Support Enforcement (OCSE), guaranteeing transparency and accountability in every case.

How Does SSIS 469 Work?

When a child support case is created or updated in the SSIS database, the system assigns a classification code like 469. That code informs both automated systems and human officers about what actions are necessary.

Here’s how the process works:

- Case Initialization – When a case begins, data is entered into SSIS, including both parents’ information, income, and custody details.

- Code Assignment – The system assigns a code (e.g., 469) based on the case’s enforcement stage.

- Trigger Mechanism – If payments are missed, the code activates linked enforcement tools (like wage withholding).

- Data Sharing – The code syncs with national databases such as the Federal Parent Locator Service (FPLS) to track employment or assets across states.

- Monitoring & Reporting – The system continuously updates the enforcement status and generates reports for federal compliance reviews.

This automation ensures uniformity across all 58 California counties, reducing the chances of miscommunication between agencies.

Who Is Affected by SSIS 469?

Custodial Parents

For custodial parents—the ones who receive child support—SSIS 469 provides transparency and faster enforcement. Once their case is tagged under this code, they can track payments, see enforcement status, and receive updates through the DCSS online portal or mobile app.

Benefits include:

- Consistent payment schedules.

- Reduced need for in-person hearings.

- Automatic enforcement without manual filing.

Non-Custodial Parents

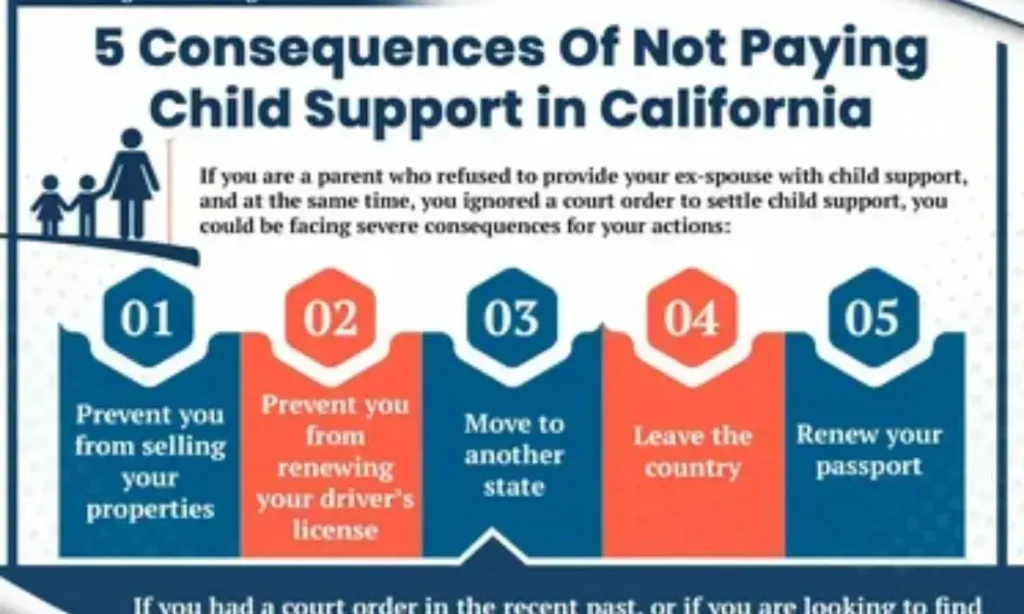

For non-custodial parents (those who pay child support), SSIS 469 determines how and when enforcement actions occur. A code assignment might trigger:

- Wage garnishment orders sent directly to employers.

- Tax refund interceptions to cover unpaid arrears.

- License suspensions for significant non-compliance.

- Bank account levies to collect overdue payments.

However, SSIS 469 also ensures due process by providing notification before enforcement, allowing parents to dispute or correct errors.

Tools Used for Enforcement Under SSIS 469

California uses a suite of automated and manual enforcement tools connected to SSIS 469. These include:

| Tool | Function |

|---|---|

| Income Withholding Orders | Automatically deducts support payments from wages. |

| Bank Levies | Collects funds directly from checking or savings accounts. |

| Tax Refund Intercepts | Redirects state and federal refunds toward unpaid support. |

| License Suspensions | Restricts driving or occupational licenses until arrears are cleared. |

| Passport Denials | Prevents international travel for those with major arrears. |

| Credit Bureau Reporting | Reports overdue payments, affecting credit scores. |

| Court Contempt Actions | Used as a last resort when other tools fail. |

These tools are authorized under the California Family Code and Title IV-D federal mandates, ensuring they comply with both state and national law.

Legal Framework Behind SSIS 469

SSIS 469 is grounded in a combination of state and federal law.

Federal Basis:

- Title IV-D of the Social Security Act requires every state to maintain a standardized enforcement system.

- The Office of Child Support Enforcement (OCSE) monitors compliance and grants funding to states that meet operational standards.

California Law:

- The California Family Code governs local procedures for child support enforcement.

- The Department of Child Support Services (DCSS) oversees the SSIS, ensuring uniform procedures statewide.

Local Child Support Agencies (LCSAs) act as the implementing arms, using SSIS codes like 469 to track and enforce individual cases.

Benefits of SSIS 469

For Children and Custodial Parents

- Guaranteed support flow: Payments are automated and monitored.

- Faster enforcement: Less delay in initiating action against delinquent payers.

- Access to real-time data: Parents can check case updates online.

- Improved reliability: Federal audits show improved collection rates in SSIS-managed cases.

For the Legal System

- Streamlined case management: Fewer manual filings and misfiled documents.

- Uniform reporting: State and federal reporting standards are consistent.

- Audit-friendly data: Easier compliance during OCSE audits.

Challenges and Criticism of SSIS 469

While SSIS 469 has improved efficiency, it’s not without criticism.

Key challenges include:

- Administrative errors: Incorrect code assignments can cause wrongful garnishments.

- Data synchronization delays: Inter-agency data lags can misrepresent payment status.

- Low-income concerns: Critics argue it disproportionately impacts parents struggling financially.

- Due process risks: Notices may not always arrive before enforcement actions occur.

Case Example:

In 2023, several California counties faced complaints over delayed notifications for wage garnishments, leading to disputes about arrear accuracy. DCSS responded by improving internal audit schedules and integrating real-time status alerts.

How to Comply with SSIS 469

Compliance is straightforward if you know the rules.

For Non-Custodial Parents:

- Make payments through authorized DCSS channels (not direct transfers).

- Keep employment information current in the SSIS database.

- Respond promptly to notices.

- Request a case review if your financial situation changes.

For Custodial Parents:

- Report changes in custody or residence.

- Verify received payments through the DCSS Customer Connect portal.

- Avoid informal agreements that bypass the system—they aren’t enforceable under SSIS 469.

How to Challenge Errors in SSIS 469 Records

Mistakes can happen, but California law provides ways to fix them.

Steps to Correct an Error:

- Contact the Local Child Support Agency (LCSA) handling your case.

- Request a case audit to verify payment records.

- Submit documentation (bank statements, receipts, or pay stubs).

- If unresolved, file a State Hearing Request through DCSS.

- As a last resort, petition the Superior Court for judicial review.

Tip: Always keep documentation of all payments and communications with DCSS.

SSIS 469 and Modernization Efforts

California’s child support infrastructure is evolving. The CSE Modernization Project, part of DCSS’s digital transformation, integrates SSIS 469 with new systems that support real-time data processing and predictive enforcement.

Modern upgrades include:

- API integrations with payroll systems for faster wage garnishment.

- Machine learning models that predict non-payment risks.

- Mobile app access for parents to view and manage cases instantly.

These innovations aim to make SSIS 469 faster, more transparent, and less error-prone.

SSIS 469 vs. Other State Systems

Every state has its own child support management system. California’s SSIS 469 stands out for its depth and automation.

| State | System Name | Key Difference |

|---|---|---|

| California | SSIS (Code 469) | Integrated real-time enforcement database |

| Texas | TXCSES | Focuses on court-based enforcement |

| New York | CSMS | Combines local court data with payment systems |

| Florida | CLCS | Manages child support through revenue department |

California’s system leads in inter-agency integration, linking directly to federal databases like FPLS and NDNH.

SSIS 469 in the Context of Federal Child Support Programs

SSIS 469 is a state-level implementation that connects seamlessly with federal systems.

It interacts with:

- FPLS (Federal Parent Locator Service) – Tracks employment nationwide.

- FIDM (Financial Institution Data Match) – Locates bank accounts for enforcement.

- OCSE (Office of Child Support Enforcement) – Monitors state performance.

By complying with these systems, California secures federal incentive funding and maintains interoperability with other states for interstate enforcement.

Conclusion

SSIS 469 is far more than a technical code—it’s the foundation of California’s modern child support enforcement framework. By automating case tracking, ensuring compliance, and integrating with federal systems, it helps protect children’s financial stability while maintaining fairness for parents.

While challenges remain—like administrative delays or data mismatches—ongoing modernization efforts aim to strengthen the system’s transparency and reliability. Whether you’re a custodial or non-custodial parent, understanding how SSIS 469 functions helps you navigate California’s child support system confidently.

FAQs About SSIS 469

What does SSIS 469 stand for?

It stands for Statewide Support Enforcement System Code 469, a classification code used in California’s child support database.

Is SSIS 469 a law or a system?

It’s a system code, not a statute, but it operates under California Family Code provisions and Title IV-D federal law.

Can SSIS 469 lead to wage garnishment?

Yes. If a case is coded under 469 due to delinquency, it can trigger wage garnishment or tax refund intercepts.

Can you challenge SSIS 469 errors?

Absolutely. You can request an audit, file a state hearing, or appeal in court if you believe your case was mishandled.

How does SSIS 469 connect to federal systems?

It shares data with federal databases like FPLS, FIDM, and OCSE to ensure cross-state enforcement and accuracy.

In summary: SSIS 469 is the backbone of California’s child support enforcement system, ensuring that every child receives financial stability, every parent gets due process, and every case meets state and federal legal standards.